Vamo

Index

About Vamo

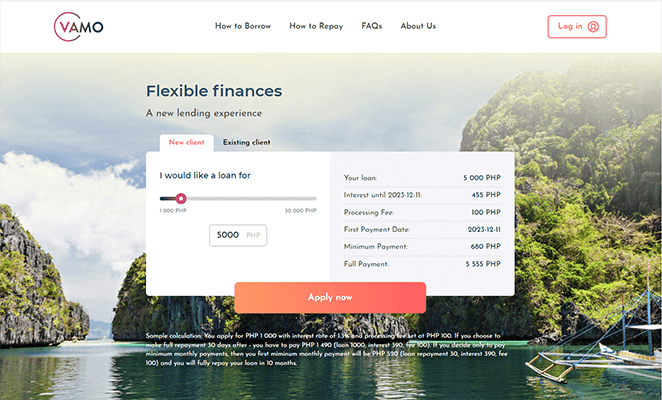

Vamo, a subsidiary of a well-known financial institution in Europe and Asia, is dedicated to meeting the financial needs of Filipinos. With a customer base of over 700,000, Vamo boasts a team of skilled professionals and cutting-edge technology.

Recognizing the need for a simple and affordable loan product that provides financial flexibility and easy access to funds, Vamo offers 24/7 online loans. In addition, the payment terms are tailored to different situations, providing the right solution for each borrower. Rely on Vamo to get an online loan that suits your financial needs.

Vamo loan terms and conditions

Carefully read the terms and conditions of the loan at Vamo. If they don't suit you, you can choose another company on our website.

| loan amount | ₱1000 - ₱30,000 |

| loan term | up to 30 days |

| interest rate | 1.3% per day |

| approvals | 36 % |

| solution time | 60 min. |

| issuing time | 60 min. |

Loan processing options at Vamo

The following loan options are available from Vamo:

Online:

- Personal bank account or e-wallet account

Vamo loan repayment methods

The following loan repayment methods are available at Vamo:

Online:

- Personal Vamo account

- Asia United Bank

- BDO

- BPI

- BPI Family Savings

- Chinabank

- Eastwest

- Landbank

- Metrobank

- PNB

- RCBC

- RCBC MyWallet

- RCBC Savings

- Robinsons Bank

- Security Bank

- UCPB

- Unionbank

- Unionbank EON

- Asia United Bank

E-Wallets:

- GCash

- GrabPay

- PayMaya

Vamo loan requirements

To borrow money from Vamo, you must meet certain requirements for borrowers.

- 20-65 years old;

- Hired persons and individual specialists;

- Filipinos;

- ID Information - We require GSIS or SSS Identification NUMBER, full name and date of birth.

- Contact information - phone and e-mail.

- Address information - your current and permanent address.

- Employment information - what kind of work you do.

- Financial information - what your current income and expenses are.

- Contact details - phone number of a family member and phone number of your colleague/human resources/supervisor.

- Payment information - bank account or one of the electronic wallets - GCash, GrabPay, PayMaya.

- Upload a photo of your physical identification document - it can be SSS, GSIS, TIN or passport.

Vamo how to get an online loan

To get an online loan from Vamo, follow some simple steps:

- Register and submit an online application. Make sure to enter your ID and phone number correctly.

- Our operators will ensure the speedy processing of your application. Make sure your phone is available to answer our call.

- Carefully study the terms of the loan and sign the agreement using the code from the SMS. We will transfer funds to your bank account or e-wallet account.

Vamo is it legal and is it worth getting a online loan.

Introduction

Vamo, a subsidiary of a well-established financial institution in Europe and Asia, has emerged as a prominent player in the Philippine microfinance sector. This review aims to assess Vamo's performance, focusing on its commitment to meeting the diverse financial needs of Filipinos through simplicity, efficiency, and flexibility.

Background and Professionalism (Rating: 4.5/5)

Backed by a Financial Powerhouse - Vamo's affiliation with a renowned financial institution in Europe and Asia lends credibility to its operations. With a substantial customer base exceeding 700,000, the company demonstrates a commitment to professionalism and financial expertise, earning a commendable 4.5 out of 5.

Application Process and Accessibility (Rating: 4/5)

Streamlined Application Process - Vamo shines in providing a straightforward application process. From registration to fund withdrawal, the steps are clearly outlined. The use of OTP (one-time password) adds an extra layer of security. However, the potential call from a customer service representative might be perceived as an additional step for some users, leading to a rating of 4 out of 5.

Loan Terms and Flexibility (Rating: 4.5/5)

Tailored Solutions - Vamo stands out in recognizing the need for flexibility in loan products. With terms tailored to different situations, borrowers can choose repayment options that align with their financial circumstances. The inclusion of both one-time repayment and minimum monthly payments showcases Vamo's commitment to providing versatile solutions, earning a commendable 4.5 out of 5.

Transparency and Information (Rating: 4/5)

Detailed Loan Terms and Conditions - Vamo ensures transparency by providing detailed information on loan terms and conditions. The company encourages potential borrowers to carefully review these terms. However, the relatively high daily interest rate of 1.3% may warrant additional clarification for borrowers, leading to a rating of 4 out of 5.

Borrower Requirements and Documentation (Rating: 4/5)

Inclusive Eligibility Criteria - Vamo's borrower requirements are inclusive, catering to a wide range of individuals. The specified documentation, including ID information, contact details, and employment information, is comprehensive but not overly burdensome. The addition of electronic wallets as payment options reflects Vamo's adaptability, earning a solid 4 out of 5.

Conclusion

In conclusion, Vamo presents itself as a reliable microfinance option in the Philippines, backed by a strong financial institution. The company excels in providing a simple, efficient, and flexible lending experience. While some aspects, such as the customer service call and daily interest rate, could be refined for an even smoother experience, Vamo's commitment to meeting diverse financial needs is evident.

Overall Rating: 4.2/5 (Good)

Vamo earns a commendable overall rating of 4.2 out of 5. The company's strengths lie in its professionalism, streamlined processes, and flexibility in loan offerings. To further enhance its user experience, addressing minor concerns in the application process and providing additional clarity on interest rates would contribute to Vamo's continued success.

Work schedule

Vamo operates according to the following schedule

| Monday: | 9am - 6pm |

| Tuesday: | 9am - 6pm |

| Wednesday: | 9am - 6pm |

| Thursday: | 9am - 6pm |

| Friday: | 9am - 6pm |

| Saturday: | rest day |

| Sunday: | rest day |

Contacts

| phone: | +63 917-706-9834 |

| email: | support@vamo.ph |

| official website: | vamo.ph |

| address: | Unit 1606-1607 11th Drive Cor. 9th Avenue, Bonifacio Global City, Taguig City. |

Vamo FAQ

answers from Vamo to popular questions

How does Vamo leverage technology to enhance the lending experience?

Vamo uses innovative technology to streamline the lending process, providing borrowers with a more efficient and accessible experience.

What repayment options are available with Vamo loans?

Vamo offers flexible repayment options, allowing borrowers to tailor their approach based on their financial situation.

Can I apply for a Vamo loan if I am self-employed or own a business?

Yes, Vamo accommodates self-employed individuals and business owners, with additional supporting documents enhancing approval chances.

What distinguishes Vamo from other microfinance companies in the Philippines?

Vamo stands out as a subsidiary of a well-known financial institution in Europe and Asia, adding credibility to its operations.

Is there a maximum number of times I can borrow from Vamo?

Vamo does not specify a maximum number of borrowing times, allowing repeat borrowers with a positive history to be considered for subsequent loans.

John Castañeda

Chief Editor

An expert in financial products who has been studying the financial market in the Philippines for more than 10 years. He uses his experience and expertise to create expert reviews of Fintech companies and analysis of the Philippine financial market.

The best alternatives to Vamo

₱1000 - ₱20,000

loan amount

7 - 14 days

loan term

approval 63 %

solution 30 min.

issuing time 30 min.

₱1000 - ₱50,000

loan amount

up to 12 months

loan term

approval 37 %

solution 60 min.

issuing time 60 min.

₱1000 - ₱25,000

loan amount

3 - 6 months

loan term

approval 27 %

solution 30 min.

issuing time 60 min.

₱500 - ₱25,000

loan amount

2 - 6 months

loan term

approval 58 %

solution 15 min.

issuing time 5 min.

₱1000 - ₱20,000

loan amount

3 - 6 months

loan term

approval 28 %

solution 60 min.

issuing time 60 min.

PH

PH