Finbro

Index

About Finbro

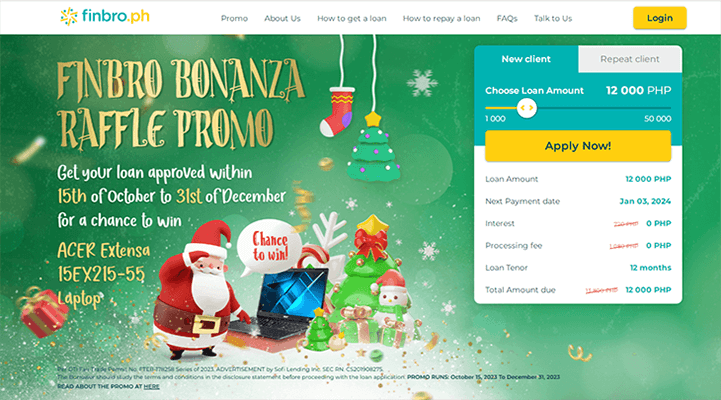

Finbro, an online lending platform in the Philippines, is designed to provide quick online loans for unexpected expenses. The platform offers a simple process to apply for a loan from the comfort of one's own home.

Finbro has simplified the approval process to make it as quick as possible. A special team of analysts works on the analysis of the borrower, which provides a quick decision and guarantees the timely receipt of the required amount of money. Finbro offers clear and straightforward loan terms.

Experience the convenience of modern credit with Finbro. We strive to provide you with a fast and reliable solution when unexpected expenses arise, ensuring that you can confidently overcome financial problems and regain control of your life.

Finbro loan terms and conditions

Carefully read the terms and conditions of the loan at Finbro. If they don't suit you, you can choose another company on our website.

| loan amount | ₱1000 - ₱50,000 |

| loan term | up to 12 months |

| interest rate | from 0% |

| approvals | 37 % |

| solution time | 60 min. |

| issuing time | 60 min. |

Loan processing options at Finbro

The following loan options are available from Finbro:

Online:

- Personal bank account

E-Wallets:

- Gcash

- PayMaya

Finbro loan repayment methods

The following loan repayment methods are available at Finbro:

Online:

- Bank transfer

E-Wallets:

- Gcash

- PayMaya

- ShopeePay

- CliQQ

Payment centers:

- 7-Eleven

- MLhuillier

- Cebuana Lhuillier

- Palawan Express

- Payment Center

- SM Bills

Finbro loan requirements

To borrow money from Finbro, you must meet certain requirements for borrowers.

- Age: 20 - 70 years old;

- Location: Nationwide;

- Job: Have a stable income.

You will need at least a valid ID (we accept SSS, UMID, driver's license, passport) and a valid mobile phone number to get a loan from Finbro.

Finbro how to get an online loan

To get an online loan from Finbro, follow some simple steps:

- Register an account.

- Fill in your personal information and submit a valid ID and Selfie.

- Wait for a decision on the loan application.

- Receive your money

Finbro is it legal and is it worth getting a online loan.

Introduction

Finbro, an online lending platform based in the Philippines, has positioned itself as a convenient solution for those seeking quick loans to cover unexpected expenses. In this review, we will delve into the key aspects of Finbro's services, evaluating its ease of use, transparency in terms, and the overall reliability of its offerings.

Application Process and Accessibility (Rating: 4/5)

Easy Application - one of Finbro's standout features is its user-friendly application process. Accessible from any mobile device or computer, the platform allows users to submit basic information online, eliminating the need for extensive paperwork. This simplicity earns Finbro a commendable 4 out of 5.

Documentation Requirements and Simplicity (Rating: 4.5/5)

Simple Documentation - Finbro takes pride in its streamlined documentation requirements. Requiring only one valid ID and a selfie, the company has successfully removed unnecessary barriers often associated with loan applications. This simplicity is highly appreciated, earning Finbro a rating of 4.5 out of 5.

Speed and Reliability (Rating: 4.5/5)

Fast and Reliable Service - Finbro lives up to its promise of a swift lending experience. The platform boasts a dedicated team of analysts, ensuring that loan applications are reviewed within minutes. The same-day transfer upon approval adds to the reliability of Finbro's services. This efficiency earns the company a commendable 4.5 out of 5.

Security and Compliance (Rating: 4/5)

Data Privacy Compliance - in an era where data security is paramount, Finbro reassures its users by being a Data Privacy Act compliant company. This commitment to safeguarding information contributes positively to the platform's credibility, earning it a solid 4 out of 5.

Loan Terms and Amounts (Rating: 4/5)

Clear and Straightforward - Finbro offers loans ranging from PHP 1,000 to PHP 50,000 with flexible payment terms extending up to 12 months. The clarity in its loan terms is a commendable aspect, ensuring borrowers are well-informed. However, a slightly wider range of loan amounts could enhance its versatility, leading to a rating of 4 out of 5.

Conclusion

In conclusion, Finbro stands out as an efficient and accessible online lending platform in the Philippines. Its commitment to simplicity, speed, and reliability in the lending process makes it a valuable resource for those facing unforeseen financial challenges.

Overall Rating: 4.2/5 (Good)

Finbro has demonstrated commendable performance across various aspects, earning it a solid overall rating of 4.2 out of 5. While there is always room for improvement, particularly in diversifying the range of loan amounts, Finbro's commitment to user-friendly processes and data privacy compliance makes it a trustworthy choice for individuals seeking quick and convenient financial solutions.

Work schedule

Finbro operates according to the following schedule

| Monday: | 8am - 5pm |

| Tuesday: | 8am - 5pm |

| Wednesday: | 8am - 5pm |

| Thursday: | 8am - 5pm |

| Friday: | 8am - 5pm |

| Saturday: | 8am - 5pm |

| Sunday: | 8am - 5pm |

Contacts

| phone: | 09176200773 |

| email: | info@finbro.ph |

| official website: | finbro.ph |

| address: | Unit 1405 East Tower Philippine Stock Exchange Center Exchange Road Ortigas, Pasig City |

Finbro FAQ

answers from Finbro to popular questions

What is the maximum loan term offered by Finbro?

Finbro offers loan terms of up to 12 months, providing borrowers with an extended period for repayment.

How does Finbro ensure the security of my personal information?

Finbro emphasizes data privacy and complies with the Data Privacy Act, ensuring the security and confidentiality of borrower information.

Can I apply for a Finbro loan using my smartphone?

Yes, Finbro provides convenience with its online platform, allowing borrowers to apply for loans using smartphones or computers.

Are there any additional charges or hidden fees with Finbro loans?

Finbro emphasizes clear and straightforward loan terms, minimizing the possibility of hidden fees or additional charges.

Can I apply for a Finbro loan if I have a low credit score?

Finbro considers a comprehensive analysis of the borrower's profile, not solely based on credit score, increasing accessibility for individuals with varying credit histories.

John Castañeda

Chief Editor

An expert in financial products who has been studying the financial market in the Philippines for more than 10 years. He uses his experience and expertise to create expert reviews of Fintech companies and analysis of the Philippine financial market.

The best alternatives to Finbro

₱1000 - ₱20,000

loan amount

7 - 14 days

loan term

approval 63 %

solution 30 min.

issuing time 30 min.

₱1000 - ₱25,000

loan amount

3 - 6 months

loan term

approval 27 %

solution 30 min.

issuing time 60 min.

₱500 - ₱25,000

loan amount

2 - 6 months

loan term

approval 58 %

solution 15 min.

issuing time 5 min.

₱1000 - ₱20,000

loan amount

3 - 6 months

loan term

approval 28 %

solution 60 min.

issuing time 60 min.

PH

PH