Digido

Index

About Digido

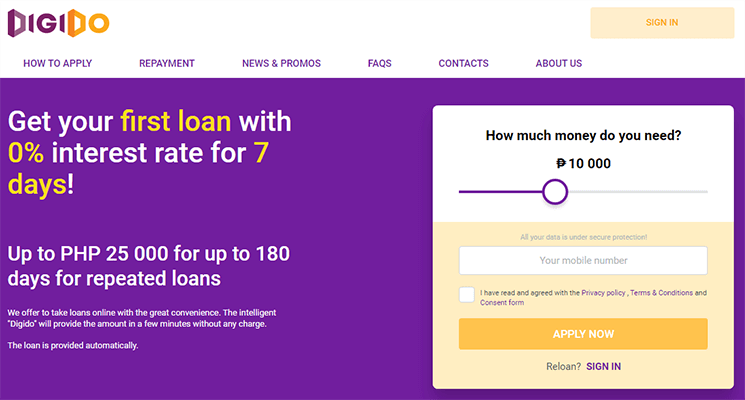

Digido is an advanced microfinance company that has revolutionized online lending in the Philippines since its inception in 2018. Focused on digital innovation, Digido empowers individuals and small businesses. business by providing convenient and affordable loans through its advanced online platform. A streamlined loan application process and quick turnaround time are key features for borrowers seeking financial assistance.

Digido understands the needs of the local market and adapts its loan offerings to different financial situations. By promoting financial inclusion in the Philippines, Digido aims to make it easier for Filipinos to obtain loans, thereby contributing significantly to the growth and development of the Philippine economy.

Digido loan terms and conditions

Carefully read the terms and conditions of the loan at Digido. If they don't suit you, you can choose another company on our website.

| loan amount | ₱1000 - ₱25,000 |

| loan term | 3 - 6 months |

| interest rate | 0 - 1.5 % per day |

| approvals | 27 % |

| solution time | 30 min. |

| issuing time | 60 min. |

Loan processing options at Digido

The following loan options are available from Digido:

Online:

- Personal bank account

Digido loan repayment methods

The following loan repayment methods are available at Digido:

Online:

- Personal Digido account

- Bank transfer

Digido loan requirements

To borrow money from Digido, you must meet certain requirements for borrowers.

Any Filipino citizen within the age group of 21-70 years, with a working mobile connection, can apply for a Digido loan.

The applicant must submit a government-issued identity card. Including documents such as payslips, COE, ITR, company ID, DTI (if self-employed or with a business) with the loan application will increase your chances of loan approval.

Digido how to get an online loan

To get an online loan from Digido, follow some simple steps:

- Register an account.

- Fill out the loan application form.

- Accept money.

Digido is it legal and is it worth getting a online loan.

Introduction

Digido, an advanced microfinance company established in 2018, has swiftly become a trailblazer in reshaping the landscape of online lending in the Philippines. This review aims to delve into Digido's innovative approach, assessing its impact on financial empowerment, digital convenience, and contribution to the local economy.

Digital Innovation and Empowerment (Rating: 4.5/5)

Revolutionizing Online Lending - Digido's commitment to digital innovation is evident in its streamlined online lending platform. Since its inception, the company has successfully empowered individuals and small businesses by providing convenient and affordable loans. The focus on quick turnaround times and a hassle-free application process merits Digido a commendable 4.5 out of 5.

Adaptability to Local Market (Rating: 4/5)

Tailored Loan Offerings - Digido demonstrates a keen understanding of the local market's diverse financial needs. By adapting its loan offerings to different financial situations, the company promotes financial inclusion in the Philippines. This flexibility is a positive aspect, earning Digido a solid 4 out of 5.

Loan Terms and Conditions (Rating: 4.5/5)

Transparent and Affordable - Digido sets a high standard for transparency with clear loan terms and conditions. The range of loan amounts, terms extending up to 6 months, and a variable interest rate from 0 to 1.5% per day showcase a commitment to affordability. The company's dedication to providing accessible financial solutions is commendable, earning Digido a rating of 4.5 out of 5.

User-Friendly Loan Application (Rating: 4/5)

Simple Application Process - Digido's online loan application process is user-friendly and efficient. With a quick solution time of 30 minutes and funds issued within 60 minutes, Digido prioritizes the needs of borrowers seeking prompt financial assistance. However, providing more details on the approval process could enhance user confidence, resulting in a rating of 4 out of 5.

Inclusive Lending Criteria (Rating: 4.5/5)

Widening Financial Access - Digido's inclusive lending criteria cater to a broad spectrum of Filipino citizens, fostering financial inclusivity. The age range of 21-70 years and the requirement of only a working mobile connection make it accessible to a wide audience. The additional option for self-employed individuals to submit relevant business documents further demonstrates Digido's commitment to widening financial access, earning a rating of 4.5 out of 5.

Conclusion

In conclusion, Digido stands out as an innovative force in the Philippine microfinance sector, leveraging digital advancements to empower individuals and businesses. Its commitment to transparency, adaptability, and inclusivity positions Digido as a significant contributor to the financial growth of the Philippine economy.

Overall Rating: 4.3/5 (Good)

Digido receives a commendable overall rating of 4.3 out of 5. The company excels in digital innovation, affordability, and inclusivity, contributing positively to the accessibility of financial services in the Philippines. Addressing minor details in the application process could further enhance the overall user experience.

Work schedule

Digido operates according to the following schedule

| Monday: | 8am - 5pm |

| Tuesday: | 8am - 5pm |

| Wednesday: | 8am - 5pm |

| Thursday: | 8am - 5pm |

| Friday: | 8am - 5pm |

| Saturday: | 8am - 5pm |

| Sunday: | 8am - 5pm |

Contacts

| phone: | (02) 8876-84-84 |

| official website: | digido.ph |

| address: | Units P107003R, P107007R, P107008R, Level 7 Cyberpark Tower1, 60 Gen. Aguinaldo Ave., Cubao, Quezon City, Philippines 1109 |

Digido FAQ

answers from Digido to popular questions

What distinguishes Digido from other lending platforms?

Digido stands out with its affiliation to a well-known financial institution and a commitment to leveraging innovative technology for a seamless lending experience.

Can I repay my Digido loan before the end of the term?

Yes, Digido offers flexibility, allowing borrowers to repay the loan entirely at any time before the end of the loan term.

How long does it take for Digido to review and approve loan applications?

Digido aims for a quick solution time of 30 minutes, ensuring rapid reviews and decisions on loan applications.

Is there a limit to the number of times I can borrow from Digido?

No, repeat borrowers with a positive repayment history may be automatically approved for subsequent loans.

What are the primary requirements to borrow from Digido?

To borrow from Digido, you need to be a Filipino citizen aged 21-70, have a working mobile connection, and provide a valid government ID.

John Castañeda

Chief Editor

An expert in financial products who has been studying the financial market in the Philippines for more than 10 years. He uses his experience and expertise to create expert reviews of Fintech companies and analysis of the Philippine financial market.

The best alternatives to Digido

₱1000 - ₱20,000

loan amount

7 - 14 days

loan term

approval 63 %

solution 30 min.

issuing time 30 min.

₱1000 - ₱50,000

loan amount

up to 12 months

loan term

approval 37 %

solution 60 min.

issuing time 60 min.

₱500 - ₱25,000

loan amount

2 - 6 months

loan term

approval 58 %

solution 15 min.

issuing time 5 min.

₱1000 - ₱20,000

loan amount

3 - 6 months

loan term

approval 28 %

solution 60 min.

issuing time 60 min.

PH

PH