Moneycat

Index

About Moneycat

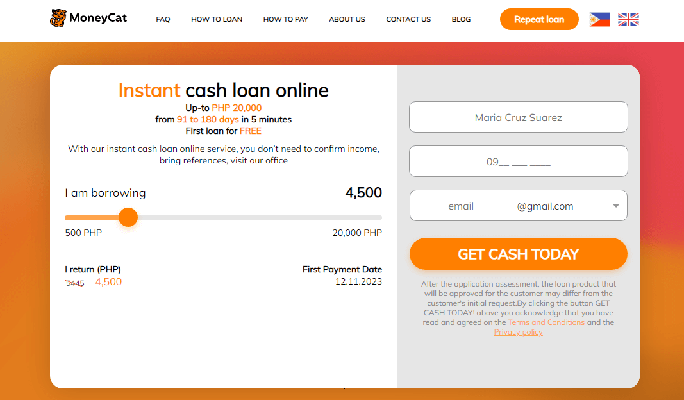

MoneyCat, a reliable financial service that offers easy and fast loan solutions. By filling out a simple online application, users can receive an online loan in their bank account within 24 hours.

MoneyCat focuses on convenience by eliminating paperwork and long waiting times at bank branches. Whether it's for unexpected expenses or personal needs, MoneyCat provides reliable financial support with short-term loans.

Moneycat loan terms and conditions

Carefully read the terms and conditions of the loan at Moneycat. If they don't suit you, you can choose another company on our website.

| loan amount | ₱1000 - ₱20,000 |

| loan term | 3 - 6 months |

| interest rate | 0 - 3% per day |

| approvals | 28 % |

| solution time | 60 min. |

| issuing time | 60 min. |

Loan processing options at Moneycat

The following loan options are available from Moneycat:

Personal bank account:

- Banco De Oro

- Bank of the Philippine Islands

- Chinabank

- EastWest Bank

- MBTC

- Philippine National Bank

- RCBC

- myWallet

- Security Bank

- UnionBank

- Land Bank

- UCPB

- Asia United Bank

- BPI

- Family Savings Bank

Moneycat loan repayment methods

The following loan repayment methods are available at Moneycat:

Online:

- Personal MoneyCat account

- Bank transfer

E-Wallets:

- Gcash

- PayMay

- ShopeePay

- Coins.ph

Payment centers:

- Cebuana Lhuillier

- Robinson's Malls

- Robinson's Bank

- Maybank

- LandBank

- Equicom Bank

- Western Union

- Palawan Pawnshop

- LBC

- Villarica Pawnshop

- PBCom

- Philtrust

- Payment Center

- SM Payment Center

- 7/Eleven

Moneycat loan requirements

To borrow money from Moneycat, you must meet certain requirements for borrowers.

- the age of the client is 22 years old and older;

- the client has a stable income;

- the client has a personal operating bank account;

- Filipinos currently living in the Philippines;

- client has 1 valid ID (UMID, SSS ID or TIN).

Moneycat how to get an online loan

To get an online loan from MoneyCat, follow some simple steps:

- Go to the main page of the MoneyCat website;

- Register an account and make sure to fill in all the information correctly;

- Confirm the loan agreement with an OTP message. The OTP is sent to the registered mobile phone number;

- Our verifiers will contact you to confirm the information (optional). Please make sure you are available for incoming phone calls.

Moneycat is it legal and is it worth getting a online loan.

Introduction

MoneyCat, positioned as a reliable financial service, offers easy and fast loan solutions to individuals in the Philippines. This review explores the company's commitment to convenience, reliability, and accessibility in providing short-term financial support through its online platform.

Convenient and Fast Loan Solutions (Rating: 4.5/5)

Streamlined Application Process - MoneyCat impresses with its commitment to convenience, allowing users to fill out a simple online application and receive an online loan in their bank account within 24 hours. The elimination of paperwork and long waiting times at bank branches enhances the overall user experience, earning MoneyCat a commendable rating of 4.5 out of 5.

Transparent Loan Terms and Conditions (Rating: 4/5)

Accessible Financial Support - MoneyCat provides clear and transparent loan terms and conditions, offering amounts ranging from ₱1000 to ₱20,000 with a flexible loan term of 3 to 6 months. The variable interest rate of 0 to 3% per day caters to different financial situations. While generally accessible, a slightly lower maximum interest rate could enhance borrower affordability, resulting in a rating of 4 out of 5.

Inclusive Lending Criteria (Rating: 4.5/5)

Accessibility for Filipinos - MoneyCat maintains inclusive lending criteria, ensuring accessibility for Filipinos. The age requirement of 22 years and older, stable income, personal operating bank account, and a valid ID contribute to financial inclusivity. This commitment to accessibility earns MoneyCat a solid rating of 4.5 out of 5.

User-Friendly Loan Application (Rating: 4/5)

Simple Steps - MoneyCat's online loan application process is user-friendly. Registering an account, filling in information, and confirming the loan agreement with an OTP message are straightforward steps. The optional verification call adds a personal touch. However, providing more information about the verification process could enhance user confidence, resulting in a rating of 4 out of 5.

Conclusion

In conclusion, MoneyCat emerges as a reliable and convenient financial solution provider in the Philippines. With its commitment to streamlined processes, transparency, inclusivity, and user-friendly applications, MoneyCat stands out as a trustworthy option for those seeking short-term financial support.

Overall Rating: 4.3/5 (Good)

MoneyCat earns a commendable overall rating of 4.3 out of 5. The company excels in convenience, transparency, and inclusivity. Minor refinements in interest rates and additional information during the verification process could further enhance the overall user experience.

Work schedule

Moneycat operates according to the following schedule

| Monday: | 9am - 6pm |

| Tuesday: | 9am - 6pm |

| Wednesday: | 9am - 6pm |

| Thursday: | 9am - 6pm |

| Friday: | 9am - 6pm |

| Saturday: | rest day |

| Sunday: | rest day |

Contacts

| phone: | 09688747401 |

| email: | support@moneycat.ph |

| official website: | moneycat.ph |

| address: | Unit 1701 Tycoon bldg Pearl Drive st. Brgy San Antonio Ortigas Center Pasig City, ph 1800. |

Moneycat FAQ

answers from Moneycat to popular questions

How quickly can I expect to receive the funds from my Moneycat loan?

Moneycat aims for swift disbursement, with funds typically transferred to your bank account within 24 hours of loan approval.

Does Moneycat offer loans for specific purposes, such as emergencies or personal needs?

Yes, Moneycat provides reliable financial support for various purposes, including unexpected expenses or personal needs.

Can I apply for a Moneycat loan if I have no credit history?

Yes, Moneycat considers various factors, making it possible for individuals with no credit history to apply for loans.

What is the range of interest rates offered by Moneycat?

Moneycat offers a daily interest rate ranging from 0 to 3%, providing flexibility based on the borrower's specific financial situation.

Is the loan application process with Moneycat user-friendly?

Yes, Moneycat's online application process is designed to be user-friendly, with a simple form and minimal documentation requirements.

John Castañeda

Chief Editor

An expert in financial products who has been studying the financial market in the Philippines for more than 10 years. He uses his experience and expertise to create expert reviews of Fintech companies and analysis of the Philippine financial market.

The best alternatives to Moneycat

₱1000 - ₱20,000

loan amount

7 - 14 days

loan term

approval 63 %

solution 30 min.

issuing time 30 min.

₱1000 - ₱50,000

loan amount

up to 12 months

loan term

approval 37 %

solution 60 min.

issuing time 60 min.

₱1000 - ₱25,000

loan amount

3 - 6 months

loan term

approval 27 %

solution 30 min.

issuing time 60 min.

₱500 - ₱25,000

loan amount

2 - 6 months

loan term

approval 58 %

solution 15 min.

issuing time 5 min.

PH

PH