Kviku

Index

About Kviku

Kviku is a revolutionary online service that operates without human intervention. With its fully automated system, Kviku is the first of its kind, providing instant loans to customers 24 hours a day, seven days a week, including holidays and non-business days.

Using advanced software, Kviku takes advantage of modern technology to analyze more than 1,800 data points from a customer questionnaire. This comprehensive assessment enables Kviku to make informed decisions quickly, ensuring a seamless lending process.

By eliminating the need for human operators, Kviku offers an efficient lending process. Customers can access loans immediately, without any delay or waiting period. This accessibility and convenience makes Kviku a reliable choice for those seeking financial assistance at any time.

Experience the power of automation with Kviku, where advanced software analyzes your information and delivers fast credit solutions. Trust Kviku's innovative approach to meet your financial needs efficiently and effectively.

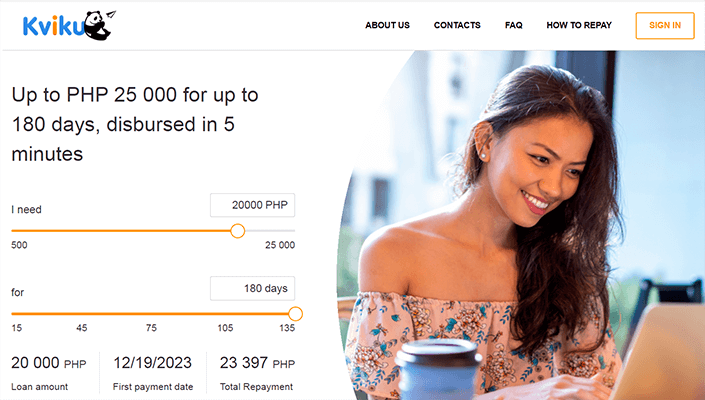

Kviku loan terms and conditions

Carefully read the terms and conditions of the loan at Kviku. If they don't suit you, you can choose another company on our website.

| loan amount | ₱500 - ₱25,000 |

| loan term | 2 - 6 months |

| interest rate | 0.16% per day |

| approvals | 58 % |

| solution time | 15 min. |

| issuing time | 5 min. |

Loan processing options at Kviku

The following loan options are available from Kviku:

Online:

- Personal na bank account

E-Wallets:

- Gcash

Payment centers:

- Cebuana Cash Pick-up

Kviku loan repayment methods

The following loan repayment methods are available at Kviku:

Online:

- Personal account on Kviku

- Bank transfer

E-Wallets:

- GCash

- GrabPay

- PayMaya

Payment centers:

- Cebuana Lhuillier

- LBC

- Bayad Center

- Robinsons Dep’t. Store

- SM Dep’t / Supermarket / Savemore Counter

- ECPay

- RD Pawnshop

- 7/11 ( Dragonloans)

Kviku loan requirements

To borrow money from Kviku, you must meet certain requirements for borrowers.

Filipino citizen, 20-55 years old and have a valid Government ID. The mobile phone number is not blocked. Registered on the website.

We only need 1 government valid ID, but it helps if you can show supporting documents such as payslip, COE, ITR, company ID, DTI (if self-employed or own a business). Repeat borrowers may be automatically approved.

Kviku how to get an online loan

To get an online loan from Kviku, follow a few simple steps:

- Fill the application form online: all you have to do is fill out our simple application form on the website, take a photo of yourself and your document.

- Wait for approval: in a few minutes, you will receive an SMS with a decision on your application.

- Receive your money instantly: your money will be transferred to your bank account within 60 minutes.

Kviku is it legal and is it worth getting a online loan.

Introduction

Kviku, a revolutionary online service in the Philippines, has redefined the lending landscape through its fully automated system. This review explores Kviku's groundbreaking approach, leveraging advanced technology to provide instant loans 24/7. The company's commitment to efficiency and accessibility sets it apart in the microfinance industry.

Automation and Innovation (Rating: 5/5)

Fully Automated System - Kviku's fully automated system marks a paradigm shift in online lending. Operating without human intervention, the platform analyzes over 1,800 data points from customer questionnaires using advanced software. This revolutionary approach earns Kviku a perfect rating of 5 out of 5 for innovation and pioneering automation.

Instant Accessibility (Rating: 5/5)

Anytime, Anywhere Loans - Kviku's commitment to providing instant loans 24/7, even on holidays and non-business days, showcases unparalleled accessibility. With no delays or waiting periods, customers experience the power of automation, making Kviku a reliable choice for those seeking financial assistance at any time. The company's dedication to instant accessibility earns it a perfect rating of 5 out of 5.

Efficiency and Speed (Rating: 4.5/5)

Streamlined Lending Process - By eliminating the need for human operators, Kviku ensures an efficient lending process. The comprehensive assessment of customer data enables informed decisions in just 15 minutes, with funds issued within 5 minutes. While the solution and issuing times are impressive, providing additional details on the decision-making process could enhance user confidence, resulting in a rating of 4.5 out of 5.

Transparent Loan Terms (Rating: 4.5/5)

Clear Terms and Conditions - Kviku provides clear and transparent loan terms, offering amounts from ₱500 to ₱25,000 with a flexible loan term of 2 to 6 months. The daily interest rate of 0.16% is reasonable. However, a slightly broader range of loan durations could enhance flexibility, leading to a rating of 4.5 out of 5.

User-Friendly Application (Rating: 5/5)

Simple and Quick Process - Kviku's online loan application is user-friendly, with a simple form on the website requiring a photo of the borrower and their document. The approval SMS within minutes and instant money transfer within 60 minutes demonstrate Kviku's commitment to a quick and hassle-free process. This user-friendly approach earns Kviku a perfect rating of 5 out of 5.

Conclusion

In conclusion, Kviku stands at the forefront of innovation in the Philippine microfinance industry, offering unparalleled accessibility and efficiency through its fully automated system. With a commitment to instant solutions and a user-friendly experience, Kviku sets a high standard for online lending.

Overall Rating: 4.8/5 (Excellent)

Kviku receives an excellent overall rating of 4.8 out of 5. The company excels in automation, accessibility, efficiency, and user-friendliness. Minor refinements in providing additional details during the lending process could further elevate the user experience.

Work schedule

Kviku operates according to the following schedule

| Lunes: | 1am - 0pm |

| Martes: | 1am - 0pm |

| Miyerkules: | 1am - 0pm |

| Huwebes: | 1am - 0pm |

| Biyernes: | 1am - 0pm |

| Sabado: | 1am - 0pm |

| Linggo: | 1am - 0pm |

Contacts

| email: | support@kviku.ph |

| official website: | kviku.ph |

| address: | 18A Trafalgar Plaza, 105 H.V. Dela Costa Street, Salcedo Village Makati City |

Kviku FAQ

answers from Kviku to popular questions

How does Kviku's fully automated system work?

Kviku's fully automated system analyzes over 1,800 data points from customer questionnaires, ensuring quick and informed lending decisions without human intervention.

Can I apply for a loan with Kviku on a holiday or non-business day?

Yes, Kviku operates 24/7, providing instant loans even on holidays and non-business days.

Are there additional benefits for repeat borrowers with Kviku?

Yes, repeat borrowers with a positive repayment history may be automatically approved for subsequent loans with Kviku.

How long does it take to receive funds after Kviku approves my loan?

Kviku aims for rapid fund disbursement, with funds typically transferred to your bank account within 60 minutes of loan approval.

What sets Kviku apart in the microfinance industry?

Kviku distinguishes itself through its pioneering automation, ensuring instant accessibility, and a commitment to a seamless lending experience.

John Castañeda

Chief Editor

An expert in financial products who has been studying the financial market in the Philippines for more than 10 years. He uses his experience and expertise to create expert reviews of Fintech companies and analysis of the Philippine financial market.

The best alternatives to Kviku

₱1000 - ₱20,000

loan amount

7 - 14 days

loan term

approval 63 %

solution 30 min.

issuing time 30 min.

₱1000 - ₱50,000

loan amount

up to 12 months

loan term

approval 37 %

solution 60 min.

issuing time 60 min.

₱1000 - ₱25,000

loan amount

3 - 6 months

loan term

approval 27 %

solution 30 min.

issuing time 60 min.

₱1000 - ₱20,000

loan amount

3 - 6 months

loan term

approval 28 %

solution 60 min.

issuing time 60 min.

PH

PH